About Altavair

OUR VISION

WHAT WE DO

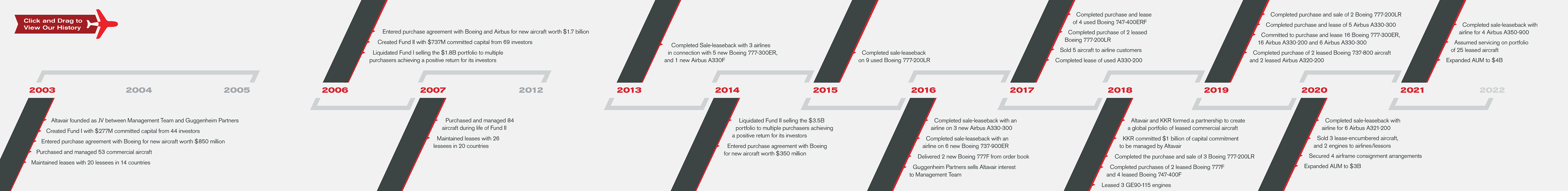

Since its inception in 2003, Altavair has completed over $11 billion in commercial aircraft lease transactions with 73 customers in 34 countries representing over 250 individual Boeing and Airbus aircraft including direct orders from the manufacturers and 17 freighter conversions.

Altavair maintains strong relationships in the commercial debt and capital markets having borrowed over $8 billion of debt from 47 financial institutions across 5 international regions and played a key role in a $600 million KROLL rated commercial aircraft private ABS. Altavair is also experienced in the private equity markets, having raised two commercial aviation investment funds representing over $2.5 billion in committed capital from a broad range of domestic and international investors including large institutional investors, university endowments, insurance companies, and family offices. More recently, Altavair formed a long-term partnership with KKR where Altavair is managing an additional $1 billion of capital from KKR related funds creating a global portfolio of leased commercial aircraft.

From locations in Seattle, London, Dublin and Singapore, Altavair represents three independent companies and teams that work together to cover the world. The members of the management and marketing teams average over 31 years of experience in commercial aviation leasing and finance and have successfully executed multiple strategies at all points within the commercial aviation cycle over the last 18 years. Based on a deep perspective and knowledge of the aviation industry, it is our experience coupled with an innovative approach to finding solutions that allows Altavair to continually provide both superior customer service and investment returns.

Altavair has remained active in the commercial

aviation market since it formed in 2003.